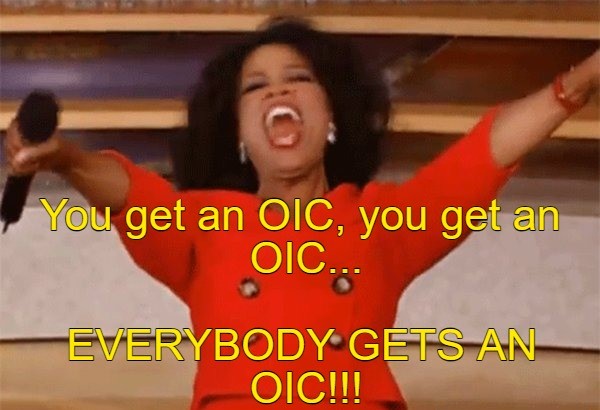

Myth: The IRS Hands Out Offers in Compromise Like Oprah Handed Out Cars on Her Giveaway Shows!

The IRS released its annual ‘Dirty Dozen’ campaign, renewing a warning about companies sometimes referred to as Offer in Compromise ‘mills’. The IRS notes that these ‘mills’ aggressively promote Offers in Compromise (OIC) and create the illusion that the IRS hands these out like Oprah handed out free cars on her big giveaway shows – …