Received an IRS bank levy?

We may still be able to get it released. Call now!

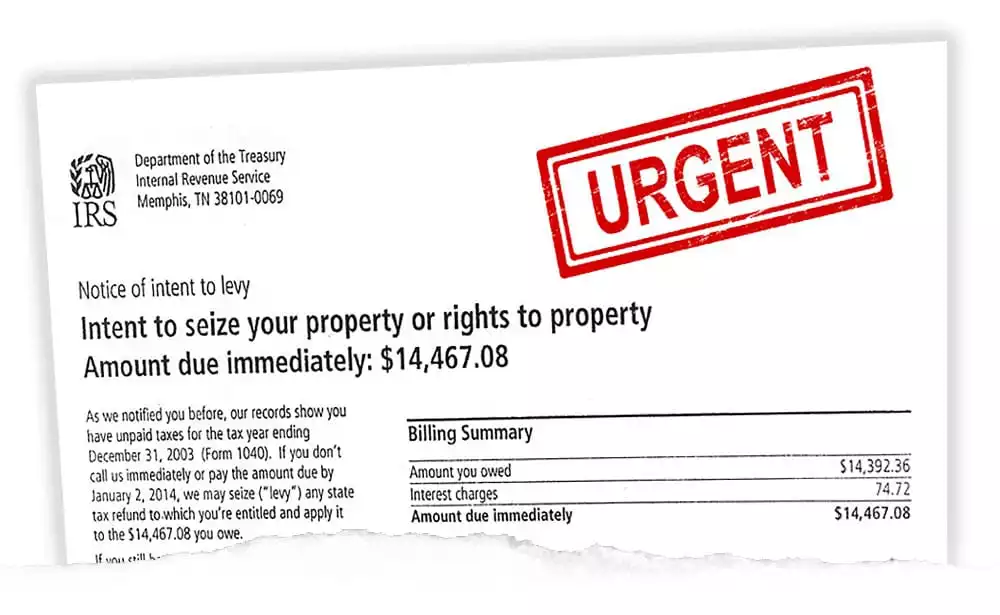

An IRS bank levy is a legal seizure of your property to satisfy a tax debt – so what should you do if you receive one? First, try to get the bank to give you a copy of the levy notice. The notice will tell you how many days you have before your money is taken out of your account. Furthermore, the notice will detail the amount that is being levied. It will also outline the specific years and the type of tax owed.

Typically, states instruct the bank to freeze your account for up to the amount on the levy notice. They are then required to forward the money within 5-15 days, depending on the state. The IRS also instructs the bank to freeze your account for up to the amount on the levy notice. However, they will normally give the bank 21 days to hold it, before it must be sent in to the IRS.

Bank levies are similar to wage garnishments, although under these circumstances the IRS or state will work with your bank rather than your employer to hold and commandeer funds for an existing tax liability.

When the IRS decides to issue a bank levy, it is important to remember that time is of the essence. While the IRS does give ample notice to both banks and taxpayers when they decide to exercise a levy, everyday counts! Most bank levies are only withdrawn once a taxpayer decides to pay down their debt via alternate means and getting approval for a payment – depending on the size and conditions of your debt – can take time. Don’t waste it! Work with a tax professional to get the job done as soon as possible.

Why Is the IRS Issuing a Bank Levy?

A tax debt with the federal government is a serious issue. If you do not manage to respond to the IRS’ warnings about your outstanding tax liability, they will initiate collection actions against you. An IRS bank levy is one such collection action.

Unlike a tax lien, in which the IRS stakes a legal claim against everything you own so you cannot freely liquidate assets or move funds around without working with the IRS, a levy is a much more direct and abrupt claim of your assets, wealth, and investments. An IRS bank levy involves emptying out your bank account or claiming exactly the amount needed to cover your current tax debt.

There are only a few ways to counter or release a bank levy. If the IRS issues a notice of bank levy, you have three weeks to respond with an appeal or evidence to the contrary or find a way to negotiate a payment plan with the IRS and begin paying down your debt on your own terms. State tax authorities are quicker to levy and may begin pulling money out of your account in as few as five days.

In addition to levying bank accounts, the IRS and state tax authorities also have the means to levy your paycheck. This is called wage garnishment. While an IRS bank levy requires the cooperation of a bank, wage garnishment is conducted through your employer. If you are self-employed or an independent contractor, chances are that the IRS will try to settle your tax debt through a bank levy rather than wage garnishment.

Of course, if a bank levy is not an option, the IRS may explore other ways to satisfy your debt, including claiming vehicles and even homes. If the IRS threatens a levy, your best bet is to contact a tax professional immediately.

What If It Isn’t My Account?

The IRS may decide to levy any bank account with your name on it, even if that account was established for someone else, like an elderly parent or a dependent.

You can contact the IRS and request that they choose a different account if you can substantiate the claim that the account is not actually for you, or that the funds are not yours.

Time is not on your side, you must act fast on your bank levy notice.

Your best chance is to get the IRS or State to agree to a full, or at least partial, bank levy release. Once the bank has sent them the money, it is extremely difficult to ever get it back. Our licensed and experienced staff here at Rush Tax Resolution know how important this may be to you. We know how to expedite the entire process for you. Every case is different, however over the past couple of years, we have very often been able to obtain an IRS bank levy release for our clients within hours after they became our clients.

Receiving an IRS levy is far from the end. While levies are some of the most powerful and drastic collection actions the IRS can take against a tax account, you as the taxpayer are never defenseless! Seeking professional recourse allows you to appeal the IRS’ decision to claim a levy against you or get in touch with the IRS and negotiate a payment plan that will work in your favor, minimize your tax debt, and perhaps even get your levy released before the IRS drains your bank account.

Bank accounts are some of the first things the IRS looks at when deciding to levy a tax account for a tax debt. But it’s important to remember that, if your debt is larger than what you’ve saved up in cash, the IRS may issue another levy on a different account, or even an asset, such as your home.

Be sure to address your tax debt with the IRS as soon as possible if you want the best chance at releasing a levy and avoiding further collection actions from the IRS. We can help you get started on a successful tax debt resolution.

What if I’ve Already Paid My Debt?

It can happen; sometimes, the IRS will continue to go through with a bank debt even though you got in touch with them in time and paid off your tax debt. Don’t panic! You can seek reimbursement. Form 8546, Claim for Reimbursement of Bank Charges, allows you to request reimbursement of the funds the IRS took in an erroneous or delayed levy action. However, there are a few prerequisites to fulfill – consider working with a tax professional to ensure that you are in the best possible position to demand repayment and take back what is yours.

Can the IRS Levy Other Accounts?

Unlike a tax lien, which is exercised over a person’s entire estate, a tax levy is applied to a single account or asset. If the IRS empties your bank account and it isn’t enough to cover your debt, they can issue another levy for the next account or asset. In addition to levying bank accounts, the IRS can claim vehicles, properties, land, and other assets under your control. In dire circumstances, the IRS can even take your house.

There are limits, of course. While the IRS can take everything in theory, in practice, taxpayers do have multiple avenues for recourse and ways to seek both legal counsel and fair judgment.

Furthermore, taxpayers can ask to be protected from IRS collection actions through indigence and financial distress. If you’re too far down on your luck, you can make the IRS back off. One way or the other, it’s important to stress that seeking legal representation can make a world of difference, especially if you’re willing to push against the IRS’ decisions on your account.

Once the IRS bank levy is released, it is critical to obtain a resolution in writing.

It is very common for the IRS or State to issue an additional levy and/or wage garnishment, if the terms of the release are not met in a timely manner. For example, the release may have been conditioned on several missing returns to be filed, and by a certain deadline. If this deadline is missed, you may get levied again. The staff here at Rush Tax Resolution will guide you through the entire process. We can expedite everything because we have our own in house tax preparers that can generally E-file the last 3 tax years. The final goal, of course, is to be protected from collections and to settle your taxes for the least amount possible. That is our specialty.

We offer a free consultation by calling us at (877) 554-7874. We only take cases that we can help.

GET HELP NOW!