A bank levy is one of the IRS’s last resorts when collecting from a taxpayer with an overdue tax bill. This guide explores the bank levy process.

Bank levies do not come out of anywhere – the IRS is obligated to give ample notice and will often try to collect in a myriad of other ways before resorting to a levy on your assets and bank accounts. The IRS currently provides a 21-day waiting period after issuing a notice (via mail) before acting on a bank levy.

If the IRS has issued a bank levy on your accounts, you can still seek action to appeal or release the levy, especially if you can prove that it would cause undue financial hardship. You can get a levy released by working out a reasonable and realistic payment plan with the IRS alone or through a tax professional, and by staying on top of all current and incoming tax payments. We are going to walk you through the bank levy process and what actions you can take.

What Is a Levy?

A levy is a last resort option employed by the IRS when all other attempts at collecting a taxpayer’s debt have failed. During the bank levy process, the IRS freezes all money currently in your bank account, as well as any money kept in other accounts to your name, save for a few key exceptions such as:

- Social Security benefits

- Various retirement benefits

- FEMA Aid

- Student loan disbursements

- Veteran benefits

- Supplemental Security Income

Once frozen, you cannot access or move this money, and the IRS is free to take as much of it as necessary to satisfy your liability to the government. The IRS reserves unique abilities as the revenue service for the US government, in that the liens and levies they apply take precedence over any other creditor unless you specifically work out an agreement with them to make an exception.

While other creditors may be within their right to claim a lien or levy on your assets and accounts, the IRS typically overrides any other creditor. This overarching privilege also means that there are very few options left for a taxpayer to resist the IRS once they issue a levy.

Bank Levies vs. Wage Levies

Bank levies allow the IRS to freeze your accounts, and withdraw money as needed to fulfill your obligation to the government. Wage levies, also known as wage garnishment, allow the IRS to automatically claim a portion of your paycheck each time it comes in until your debt is paid, or an alternative arrangement is made. The amount you receive from your wages is determined by the number of dependents you support.

Aside from typical wages, the IRS can also claim any bonuses, fees, commissions, and any other similar forms of compensation from an employer. If you are self-employed or an independent contractor, the IRS may issue a levy on your bank account instead (i.e. a bank levy). Where wage levies are issued through Form 668-W, bank levies (and other third-party levies) are issued through Form 668-A. Note that the IRS can levy bank accounts as well as real and personal property.

Levies vs. Liens

Where a levy is an automatic or one-time claim by the IRS on an account or continuous wage, a lien constitutes a claim made by the IRS on any property. This claim is a legal claim rather than an actual physical claim, which would constitute a levy. The burden on the taxpayer when a legal claim is issued is that the IRS’s debt takes precedence over any other debt.

While levies are not a matter of public record, liens are, and a lien will often cut into a taxpayer’s credit score and ability to utilize property or accounts as security for loans. Much as with a levy, the IRS must send a notice to the taxpayer before a lien can be issued. Much like a levy, a lien can also be released or withdrawn, and contesting, appealing, or getting a lien released or withdrawn is an entirely separate process.

How and When the IRS Applies Levies

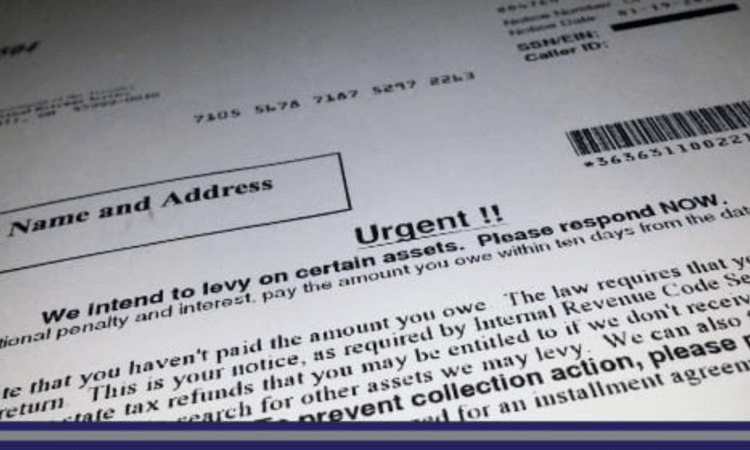

The IRS sends taxpayers a Final Notice of Intent to Levy and a Notice of Your Right to A Hearing when it intends to issue a levy, and will then send one to your employer, bank, or any other party involved. During the bank levy process, the IRS will freeze your account and use its contents to cover your tax debt. If the contents of your bank accounts are not enough to cover the entire tax debt, you will still be held liable for the remainder, and are expected to negotiate a payment plan with the IRS.

If you can prove that a bank levy has caused undue financial hardship, you can work with a tax professional to get a levy released by proving to the IRS that the bank levy is keeping you from meeting the minimum financial requirements needed to meet “reasonable living expenses”. To do so, you will have to provide the IRS with key financial information to help prove your point. Given the current unique situation (COVID-19), the IRS also offers debt relief and assistance in cases of coronavirus-related hardship. For more information, contact a local tax professional and review the IRS’s own guidelines on requesting the release of a levy due to coronavirus hardship.

Appealing a Levy

During the bank levy process, you can appeal a bank levy via the IRS’s Independent Office of Appeals, representing yourself, or through a tax professional, as per your Collection Appeal Rights. Note that the IRS will typically only review and allow an appeal if:

- You’ve already paid your tax debt;

- The period for collecting on your tax debt has passed before the levy was issued;

- The levy is causing financial hardship, and/or is keeping you from paying your tax debt;

- You have entered into a payment plan with the IRS;

- The value of the account exceeds the total tax debt, and you are able to pay the debt if the levy is released.

Again, a bank levy is not a matter of public record, which means it won’t affect your credit score, unlike a lien.