There are many common errors that taxpayers may not know about that will lead to your tax return being rejected. Here's what to know.

[lwptoc skipHeadingLevel="h3"]

If you are one of the millions of Americans required to file taxes this year, then knowing why your tax return might have been rejected in the past – and learning how to avoid it now and in the future – will be vital.

The US federal tax code is an evolving beast with millions of words, and much of it is legal jargon. The IRS is responsible for helping taxpayers interpret and comprehend their responsibilities, especially with regards to when and how to pay taxes. But there are times when the IRS is far from comprehensive.

We’re going to go over some of the more common mistakes taxpayers tend to make when filing their tax returns and how to avoid them.

Common Errors in Tax Returns

Tax returns are meant to be signed documents providing key information about the taxes you are meant to pay, based on your: understanding tax liens in your area is crucial for maintaining your financial health and avoiding potential pitfalls. Many individuals overlook the implications of tax liens, which can significantly affect credit scores and property ownership. By staying informed and educated about these liens, homeowners can make proactive decisions that protect their assets and financial future.

-

-

- Income

- Filing status, and

- Applicable deductions, credits, and refunds

-

The IRS takes the information provided by the taxpayer and cross-references it with data from thousands of other reports provided by employers, companies, credit report agencies, banks, and other institutions.

If everything lines up, your tax account may be updated (in case you have outstanding tax payments to make or are eligible for a tax credit or refund). If there’s a mistake, the IRS will usually inform you of the error and will let you know how you should proceed.

Under no circumstances should you let a rejected tax return remain unfiled. Instead, work with the IRS or a tax professional to rectify the error as soon as possible and refile.

Missing Information

Tax returns are information-heavy documents. They require you to dig up quite a lot of paperwork and demand accuracy. However, sometimes, taxpayers might get a little too caught up with the details and might lose the forest for the trees.

Some taxpayers end up forgetting to input their social security number, write down their taxpayer identification number, or simply forgot to use the right form. Unfortunately, even relatively innocent errors like a misspelled name can land you in hot water, or at the very least, get your tax return rejected.

Under certain circumstances, the IRS may require you to refile via mail. The IRS will notify you if you must do so. If the IRS did not explain why your return was rejected, you can contact them for clarification.

Major Inaccuracies

If things don’t add up, either mathematically or otherwise, your return might trigger a red flag with the IRS. This means that it may lead your return to be selected for investigation, and the IRS may ask you for more information.

Applying for certain deductions and credits that are unusual for your income, filing status, or location or making major math errors can cause the IRS to look twice.

In cases of simple math errors, the IRS will usually correct your return for you and notify you via mail that it has done so. This can lead to a larger tax bill than expected or even a tax refund.

Forgetting to Sign the Tax Return

While it seems incredibly innocuous, the IRS cites this as a relatively common mistake that taxpayers make. One reason for it may be that many taxpayers rush to finish their returns on the eleventh hour and thus forget to sign off on an otherwise completed return.

Needless to say, the IRS disapproves of unauthorized returns and is naturally disinclined to process a return that hasn’t been signed by the individual it is meant to represent.

What to Do If Your Tax Return is Rejected

The last thing you should do is wait. Instead, contact the IRS or a tax professional immediately, figure out why your return was rejected, and work with someone to fix the issue. The IRS can levy penalties and interest on your tax account if you’re tardy with your tax returns.

The IRS gives a grace period of five business days when a tax return is rejected – this means that filing within that period will still let your return count as on-time, even if it’s past the due date.

Consider professional filing services. If you’re planning to resend your tax return electronically but are unsure if you’ve sufficiently addressed the problem, you can work with a tax professional to go over your return one last time.

If your tax return was rejected due to suspected fraud, the IRS might ask you to resend your return via mail. In these cases, it may be that someone else has tried fraudulently filing with your Social Security Number.

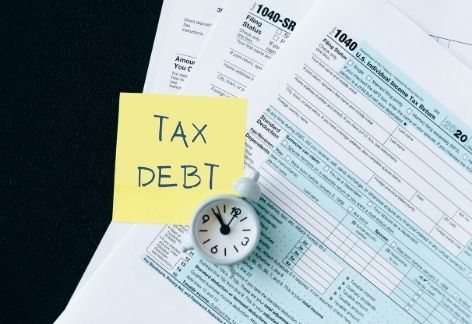

What If You Delay Your Tax Return?

Tax season comes around once a year, usually in April. However, the April date was altered in 2020 (to July 15th), as well as in 2021 (to May 17th), due to the COVID-19 pandemic.

Missing these deadlines can carry harsh consequences. However, the IRS will usually understand if you give a reasonable explanation and manage to file within the rest of the month.

For every month that your tax return is delayed, the IRS will add a penalty equal to 5 percent of the tax amount owed that year, up to a maximum of 25 percent after five months. In addition, your tax account will begin to accrue interest at rate that changes annually. This interest accumulates until the return is filed and your due balance is paid. If you were eligible for certain tax refunds, these will be automatically used up to cover your due balance.

If you continue to ignore your tax return filing duties, the IRS has more severe consequences up its sleeve.

-

-

- For one, willfully ignoring your responsibility to file your tax returns can be a criminal offense.

- Secondly, as your debt grows, the IRS can resort to a growing arsenal of collection actions to coerce payment, culminating in a Notice of Intent to Levy – wherein the government seizes your assets or garnishes a portion of your wages.

-

Don’t let things escalate with the IRS. Instead, get in touch with a tax professional today and sort out your tax issues before things blow out of proportion.