Receiving an IRS notice can be extremely daunting, but do not stress. Here is a list of five types of IRS notices and what they mean for you.

[lwptoc numeration="none" skipHeadingLevel="h3"]

The IRS sends out hundreds of thousands of notices every year to taxpayers, these IRS notices can include:

-

-

- Reminding them to review their taxes

- Send in additional information

- Notify them of a simple correspondence audit, or

- Bring news of a more severe nature, such as a notice of federal tax lien, or an intent to levy

-

It’s easy to get lost amid these IRS notices, misunderstand them, or mistake one for another. And regardless of what the IRS sends you – be it a simple request for additional information or a final notice – mail from the tax man is always intimidating.

We’re going to go over the most common IRS notices, how notices differ from letters, what most notices mean, and when (and why) you should get help from a tax professional. One of the key resources available to taxpayers is the IRS Fresh Start Program details, which can provide relief options for those struggling with unpaid tax liabilities. Understanding the nuances of this program is essential, as it offers various pathways for taxpayers to improve their financial situation. By leveraging these provisions, individuals can effectively manage their tax debt and gain peace of mind.

What Correspondence Season Means for You

Tax Day for 2021 has been extended from April 15th (the typical annual Tax Day) to May 17th as part of the government’s efforts to help bring some relief to taxpayers struggling to keep up with the changes, rebates, refunds, and benefits provided during the coronavirus crisis.

But once Tax Day has come and gone, the IRS begins correspondence season – going through mountains of data to match information returns to taxpayer returns, check for inconsistencies, and send out requests, information, and demands.

This means many taxpayers will soon find themselves receiving letters from the IRS, letters that should be opened and read. The greatest and most common mistake taxpayers make when facing a notice from the IRS is simply ignoring it.

This can backfire dramatically, as it does not stop the IRS from taking actions against your account – and in some cases, these notices exist to remind you that you have a tax refund and that the IRS is actually going to send you more money.

In other words: keep an eye on your mailbox, and don’t hesitate to open and read correspondence from the IRS as soon as you receive it. The sooner you get to act on notice, the smoother your interactions with the tax man will be.

IRS Notices vs. IRS Letters

Most correspondence from the IRS is either a notice (marked as CP#, where # is a number) or a letter (marked LTR#). Notices and letters both represent a request from the IRS to respond in some shape or form in order to help them process your case, clear up any outstanding issues, and resolve your tax situation – whatever it may be.

Many notices don’t necessarily require a response, as these may entail issues that are unfolding automatically.

Some IRS notices are certified and must be signed by the taxpayer to ensure that you understand and agree with the notice (or, if you don’t agree, you must challenge the letter or notice through a formal appeal with the IRS Independent Office of Appeals or attach information to the form attached to the notice explaining why you disagree with the IRS’s assessment of the situation).

Below are some common IRS notices to keep an eye out for.

1. Notice CP2000

A Notice CP2000 means the IRS finds that the information they have on file from third-party sources doesn’t match the information you provided on your tax return. The irs notice of deficiency explained is a formal communication indicating that the IRS believes you owe more tax than you reported. It is essential to respond promptly to avoid further penalties, and understanding the implications is crucial for navigating the appeals process. If you disagree with the findings, you have the right to present your case and provide additional documentation to support your position.

This could mean an increase or decrease in tax, or if you’re eligible for a tax credit, potentially no change at all. If there is a change, the IRS may request that you respond either by agreeing with their proposal or providing additional information to back up your tax return.

2. Notice CP3219A

This is a Notice of Deficiency, yet another notice explaining that your tax return doesn’t match information received from your employer or a bank, but this time with the added explanation that you currently owe more in taxes. This is not a formal bill from the IRS. It is simply informing you of a potential tax liability.

3. Notice CP2566

Notice CP2566 is sent out when a taxpayer’s tax return was not received by its due date, and a substitute return was created instead, based on information provided by financial institutions and an employer’s Forms W-2 or 1099. A substitute return does not keep the IRS from levying penalties against your account for failing to file a tax return.

4. Notice CP05

A Notice CP05 is an attempt by the IRS to identify cases of identity theft. If you receive a CP05 and it matches the information you sent the IRS, then no action is needed.

If you didn’t file a return and received a CP05, then someone might have used your information to file a return. You will be requested to fill out Form 14039 and mail it to the IRS alongside some requested information.

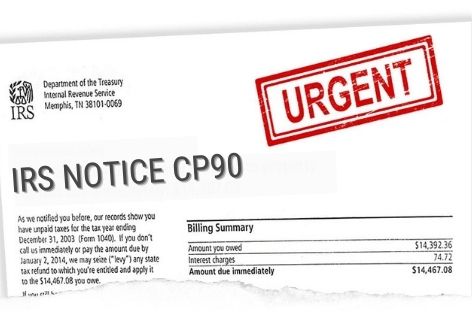

5. Notice CP90

Notice CP90 informs recipient taxpayers that the IRS is planning to levy assets for a tax liability. This is one of the last notices you will receive before the IRS begins claiming assets to satisfy your tax debt.

It is also meant to notify you of your right to a Collection Due Process hearing. If you receive this notice, act immediately. Once the IRS begins levying your assets, it will send a Notice CP90C.

Preventing IRS Notices

Some IRS notices are preventable. In general, you can avoid the vast majority of IRS notices by making no mistakes on your tax returns and paying your dues on time.

But even so, the IRS will continue to send you notices and letters whenever it needs to:

-

-

- Verify your identity

- Inform you of a tax refund that you are eligible for

- Ask questions regarding your return and the information you provided, or

- Remind you that you qualify for certain tax credits

-

Some notices simply cannot be avoided, and as previously mentioned, the last thing you should do is ignore a notice from the IRS. Doing so will only ensure that the IRS will eventually pursue actual collection actions against your account, which can lead to a physical claim of your wages, assets, or bank accounts down the line.

How Rush Can Help

Accuracy and swift action are key to avoiding unnecessary costs and stress when dealing with the tax man. Here at Rush Tax Resolution, we don’t promise miracle results, but we do promise the knowledge and experience of a team of tax professionals. Each of them is dedicated to helping you navigate the world of the IRS and reduce your tax liability to a reasonable level.

If you’re unhappy with your current tax preparation methods, are struggling to understand what the IRS wants from you, or are worried about potential collection actions on your account, don’t hesitate to give us a call.